ProLogis Closes ProLogis European Properties Fund II Financing

November 04 2009 - 9:00AM

PR Newswire (US)

- Proceeds Used to Pay Down Warehouse Line - DENVER, Nov. 4

/PRNewswire-FirstCall/ -- ProLogis (NYSE:PLD), a leading global

provider of distribution facilities, announced today it has

completed a euro 41.4 million financing on behalf of ProLogis

European Properties Fund II (PEPF II). Proceeds from the financing

were used to pay down PEPF II's warehouse line of credit. A

European bank based in Austria provided the five-year loan that is

secured by a portfolio of six assets in Poland, representing a 52

percent loan-to-value. "With this financing, we have demonstrated

our access to debt capital in the central European region with one

of the few new secured real estate loans to be completed there

during 2009. We also established a new lending relationship and are

pleased that lenders continue to be attracted to the strong and

stable cash flows generated by ProLogis' assets," said William E.

Sullivan, ProLogis' chief financial officer. About ProLogis

ProLogis is a leading global provider of distribution facilities,

with more than 475 million square feet of industrial space (44

million square meters) in markets across North America, Europe and

Asia. The company leases its industrial facilities to more than

4,500 customers, including manufacturers, retailers, transportation

companies, third-party logistics providers and other enterprises

with large-scale distribution needs. For additional information

about the company, go to http://www.prologis.com/. DATASOURCE:

ProLogis CONTACT: Investors, Melissa Marsden, +1-303-567-5622, , or

Media, Krista Shepard, +1-303-567-5907, , both of ProLogis; or

Financial Media, Suzannne Dawson of Linden Alschuler & Kaplan,

Inc., +1-212-329-1427, , for ProLogis Web Site:

http://www.prologis.com/

Copyright

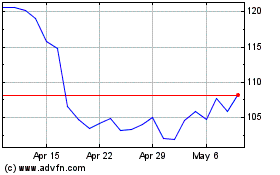

Prologis (NYSE:PLD)

Historical Stock Chart

From Apr 2024 to May 2024

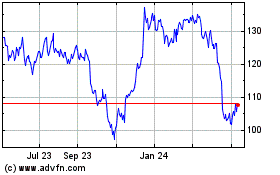

Prologis (NYSE:PLD)

Historical Stock Chart

From May 2023 to May 2024